Hiatus Vs Rocket Money - A Look At Pauses And Financial Peace

Sometimes, you know, life just throws a pause button at you, or perhaps you decide to hit that button yourself. Think about it: a break from your favorite TV show, a moment of quiet in a busy day, or maybe even a period where you step back from work for a bit. These are all instances of a "hiatus," a word that simply means a stop, a break, or a gap in something that was going along. It is a concept that touches many parts of our existence, from our entertainment to our personal well-being, and even, in a way, our money matters.

Then, there are the tools we use to help us manage the flow of things, especially when it comes to our finances. We are, after all, looking for ways to make things a little smoother, to avoid those unexpected bumps in the road, or to simply get a clearer picture of where our money goes. This is where something like Rocket Money comes into the picture, offering a different kind of support for your daily financial life. It is not a pause itself, but rather a way to help you avoid certain unwanted pauses or to help you make the most of the breaks you do take, so to speak.

So, we have this idea of a break, a "hiatus," and then we have a practical helper like Rocket Money. It might seem like a strange pairing at first, but when you really think about it, there are some interesting connections to be made. Both, in their own ways, are about managing continuity, or the lack of it, and making sure things stay on track, or get back on track, after a period of stopping. We will explore what a hiatus truly means and how a service like Rocket Money can play a part in creating a more settled financial path, allowing for more intentional pauses and fewer surprising interruptions.

- Different Strokes For Different Folks Future

- Iphone 3 Nuts Emoji Burst

- Una Desconocida Video

- Lesbian Group Kissing

- Its A Stormy Day In London Town

Table of Contents

- What is a Hiatus, Anyway?

- How Does Rocket Money Fit Into Our Daily Lives?

- Can a Hiatus Be a Good Thing for Your Finances?

- Where Do Hiatus and Rocket Money Intersect?

- Understanding the Nature of a Break- A Hiatus

- Rocket Money- A Tool for Financial Breaks

- Personal Pauses and Financial Clarity with Rocket Money

- Finding Your Financial Footing After a Hiatus

What is a Hiatus, Anyway?

When we talk about a "hiatus," we are really talking about a break, a stop, or a gap. It is a moment, or a period of time, where something that was ongoing just, well, stops for a bit. Think of it like a pause button on a video, or a space that is empty where something used to be. For instance, if your favorite show goes on a hiatus, it means there will not be new episodes for a while, not forever, just for a certain period. It is a temporary thing, a period of not doing what you usually do, or a time when something is missing from its usual spot. This is what the word generally means, and it is pretty straightforward, you know.

- Tiny From Baltimore

- Livvy Dunne Cumtribute

- Adamari L%C3%A3pez Murio

- Gentle Parenting Videos

- Its Exactly 8 Oclock Im In The Van Animation

It can also describe a space, especially in something written or spoken, where a piece is just not there. This kind of gap means something is missing from the full picture. A hiatus can be a short pause where nothing happens or nothing is said, a quiet moment in the midst of activity. So, it is a break in continuity, a stop in a sequence of events or actions. The band, for example, decided to go on hiatus, citing creative differences, which means they stopped playing together for a period. This is the core idea of a hiatus, a temporary interruption, a moment of quiet, or a space that needs filling, more or less.

How Does Rocket Money Fit Into Our Daily Lives?

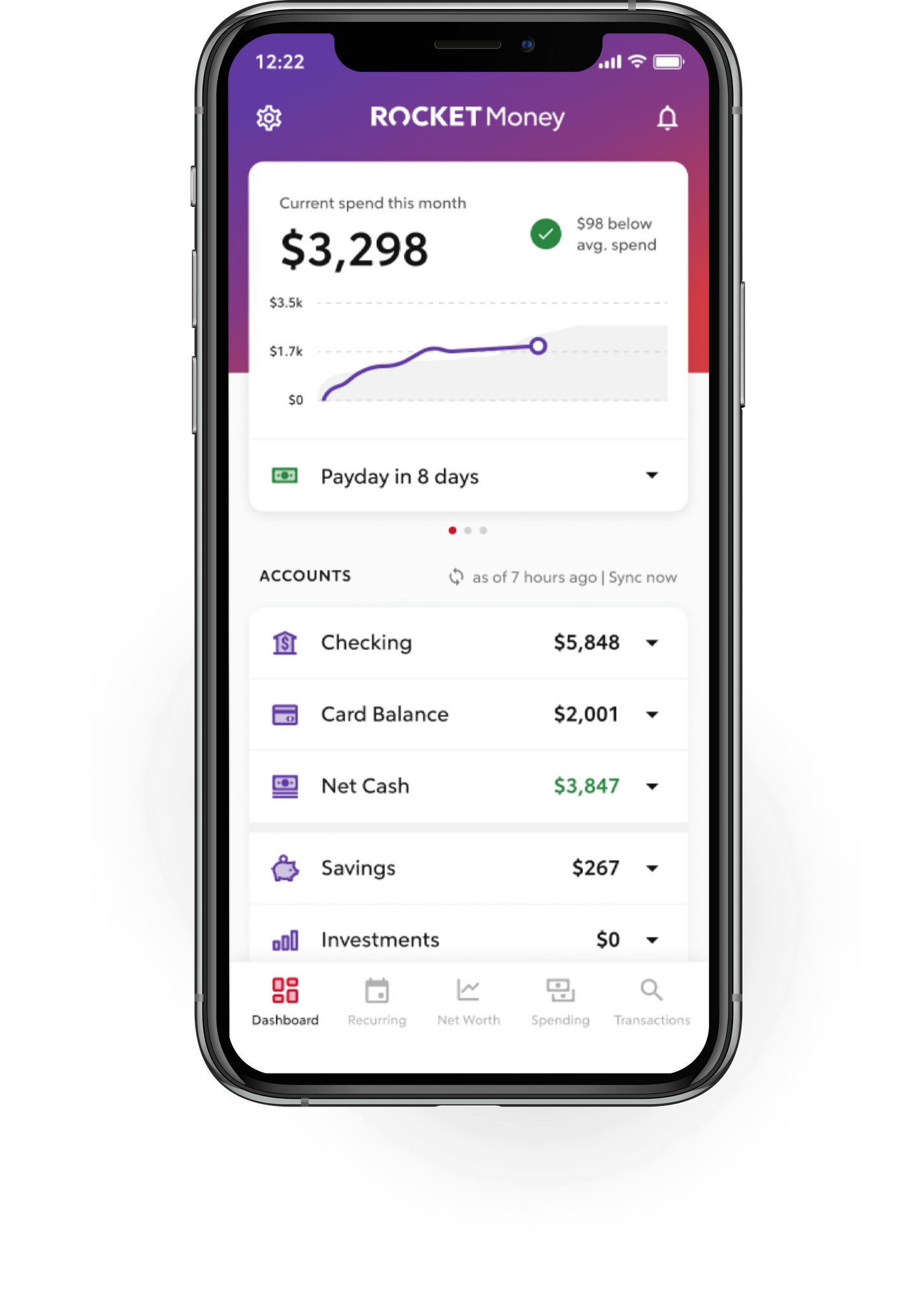

Now, shifting gears a bit, let us consider Rocket Money. This is a tool, an application really, that aims to help people get a better handle on their money situation. It is not about taking a break in the same way a TV show does, but rather about helping you avoid unwanted financial breaks, or making sure you can take the breaks you want without money worries. It works by looking at your spending, helping you spot subscriptions you might have forgotten about, and generally giving you a clearer picture of your financial flow. It is like having a helpful assistant for your money, you know, someone who points out things you might have missed.

This kind of service tries to bring a bit of calm to what can feel like a very busy part of life: your personal finances. It is about bringing things into the light, showing you where your money is going, and helping you make choices that feel right for you. It can help you find ways to save a bit here and there, or to cut out things you no longer need. In a way, it helps you put a temporary stop to wasteful spending, or to those little leaks in your budget that add up over time. So, it is about making your financial life more predictable, which, frankly, can feel like a welcome pause from stress.

Can a Hiatus Be a Good Thing for Your Finances?

Thinking about a hiatus in a financial sense can be interesting. A break from spending, for instance, or a temporary stop to new financial commitments, might actually be a very good thing. Imagine taking a "spending hiatus" for a month. This means you would not buy anything non-essential, just focusing on what you truly need. This kind of intentional pause could give your bank account a chance to catch its breath, or allow you to save up for something important. It is a way of hitting the reset button, giving yourself a chance to rethink your money habits, you know.

Sometimes, life forces a financial hiatus upon us, like a period of unemployment or unexpected expenses. These unplanned breaks can be tough, but even then, they can teach us a lot about living with less and being resourceful. They make us really look at where every penny goes. On the other hand, choosing to take a break from work, a career hiatus, for personal growth or family time, is a planned financial pause. For this kind of break to be a good thing, you need to have a clear idea of your money situation before and during the pause. This is where tools that help you see your finances clearly become very useful, more or less.

Where Do Hiatus and Rocket Money Intersect?

So, where do these two ideas, a hiatus and Rocket Money, meet up? Well, a hiatus is a break, a pause, a gap. Rocket Money, in a way, helps you manage those financial gaps or helps you take intentional financial pauses. If you are planning a financial hiatus, like saving up for a big purchase or taking time off work, Rocket Money could help you keep track of your money during that period. It helps you see where your money is going, so you can make sure your planned break does not turn into an unplanned financial problem, you know.

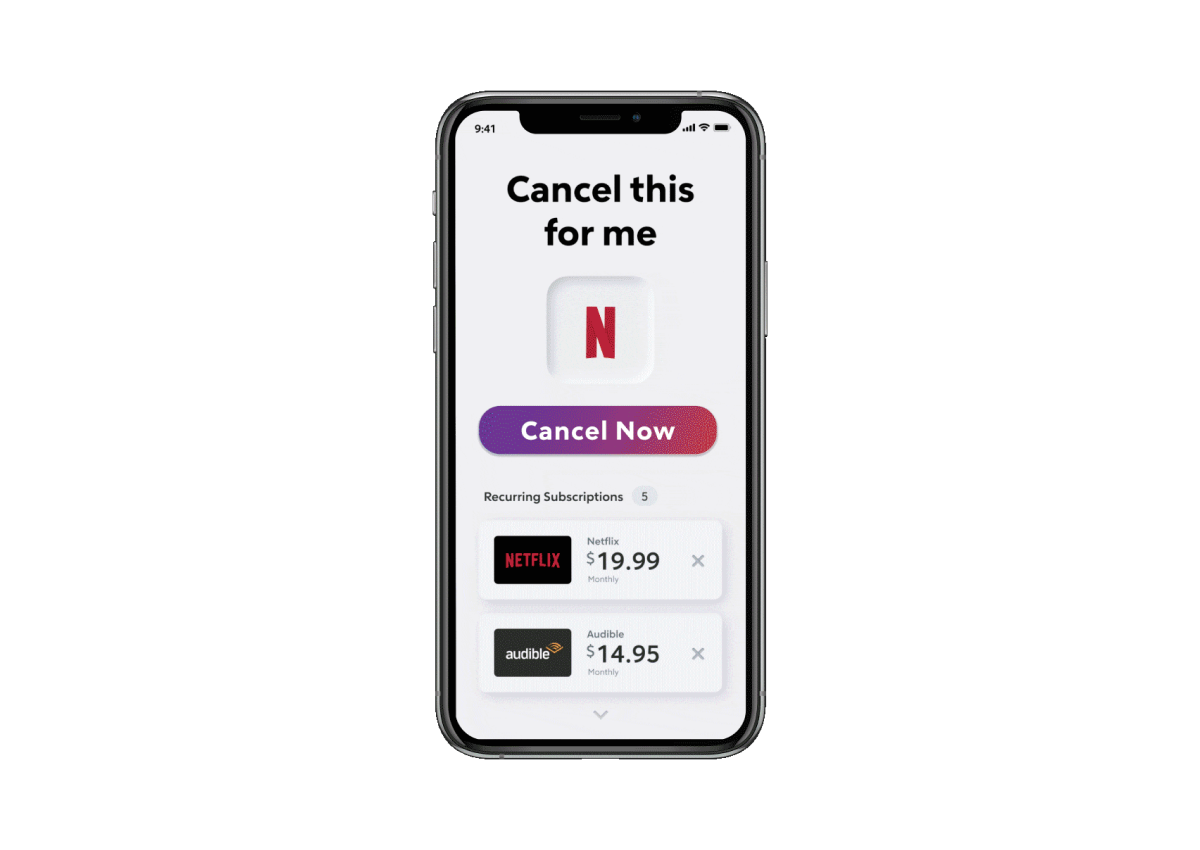

Consider the idea of a "subscription hiatus." Many of us have subscriptions we signed up for and then forgot about. These are like little financial gaps, or leaks, in our budget. Rocket Money helps you spot these forgotten payments, allowing you to put a stop to them. This is a kind of hiatus for those recurring charges, giving your money a break from flowing out unnecessarily. It helps you reclaim those small amounts, filling those little gaps in your budget, which can add up to something significant over time, basically.

Understanding the Nature of a Break- A Hiatus

Let us go a little deeper into what a hiatus truly represents. It is a period of stopping, a break in the usual order of things. When we talk about a hiatus, it is often something temporary, not a permanent end. It is like a comma in a long sentence, a moment to breathe before the sentence continues. This pause can be planned, like a band deciding to take a break from touring, or it can be something that just happens, like a short silence in a conversation. The core idea is an interruption, a cessation of activity for a while. It is a gap, a space where something is missing for a time, so.

This idea of a temporary gap or an absence can be seen in many different areas. A short pause where nothing happens or is said, that is a hiatus. A space where something is missing, that is also a hiatus. It can refer to a period of time when someone does not do something they usually do, like their work or an ongoing project. It is a break in continuity, a moment when the usual flow is interrupted. This interruption can be a chance to rest, to rethink, or to simply be still. It is a moment of quiet, a time to step back, more or less.

The meaning of hiatus, then, is very much about this idea of a break or a pause. It is not about something ending forever, but about a temporary stop. This temporary nature is key. When your favorite TV show is on hiatus, it means there are no new episodes, but you expect them to come back. It is a pause in which nothing happens for a bit, or a gap where something is missing, but not gone for good. This concept of a temporary stop is quite important when we think about how we manage our lives, including our financial lives, you know.

Rocket Money- A Tool for Financial Breaks

Now, let us bring Rocket Money back into this discussion, but with the idea of a hiatus firmly in mind. Rocket Money, as a tool, does not create a hiatus itself. Instead, it helps you manage your money in a way that can allow for intentional breaks, or help you recover from unplanned ones. Think about the way it helps you find and cancel unwanted subscriptions. Each canceled subscription is, in a way, a small financial hiatus for that particular outgoing payment. It is a pause in the flow of money from your account for something you no longer use or want, which is pretty neat, actually.

It helps you get a clearer picture of your spending habits. By showing you where your money is going, it helps you identify areas where you might want to take a "spending hiatus." Maybe you realize you are spending too much on eating out, and you decide to pause that for a month. Rocket Money gives you the information to make that choice, to create that intentional break in your spending pattern. It is about giving you control, allowing you to choose when and where you want to hit the pause button on certain financial activities, so.

Furthermore, by helping you track your bills and budgets, Rocket Money can help you avoid those sudden, unwanted financial interruptions that can feel like a negative hiatus. An unexpected overdraft fee, for instance, or a bill you forgot about, can throw your budget into a temporary state of chaos. By providing clarity and reminders, Rocket Money helps you keep things flowing smoothly, reducing the chances of those jarring financial pauses. It is about creating a more predictable and steady financial path, which, in turn, allows for more peace of mind, you know.

Personal Pauses and Financial Clarity with Rocket Money

When we think about personal well-being, taking a break, a hiatus, from the daily grind can be incredibly helpful. This could be a vacation, a mental health day, or even a longer period away from work. For these personal pauses to be truly restorative, having your finances in order can make a huge difference. You do not want to be stressed about money while you are trying to relax or recharge. This is where a tool like Rocket Money can offer a real benefit, by giving you that financial clarity you need to step away without worry, basically.

It helps you see your financial situation at a glance, allowing you to plan for those personal breaks. If you know how much you are spending and where you can cut back, you can set aside funds for your hiatus. This means your time off can truly be a break, a pause from your regular responsibilities, rather than a time filled with financial anxiety. It helps you prepare for the absence of your regular income during a planned hiatus, or helps you manage unexpected expenses that might arise during one. It is about empowering you to take those necessary personal pauses with a sense of calm, you know.

Finding Your Financial Footing After a Hiatus

Coming back from any kind of hiatus, whether it is a break from work or a period of reduced spending, can sometimes feel a bit disorienting. Your routines might be different, and your financial situation might have shifted a little. This is another point where a tool like Rocket Money can be really useful. It helps you quickly get back up to speed with your finances. You can see what bills are due, what subscriptions are active, and how your spending has changed. It provides a clear snapshot, helping you find your footing again, so to speak.

After a break, you might need to adjust your budget or restart certain financial habits. Rocket Money gives you the data to do this effectively. It helps you identify any new financial gaps that might have appeared during your hiatus, or reminds you of things you need to restart. It is like having a clear map to guide you back into your financial rhythm. This support in getting back on track means that the positive effects of your hiatus can continue, rather than being overshadowed by financial confusion or stress. It is about making the transition back into your regular financial flow as smooth as possible, more or less.

Detail Author:

- Name : Ms. Ruthe Herzog PhD

- Username : elmore21

- Email : johan.quitzon@boyer.biz

- Birthdate : 1974-03-18

- Address : 852 Lew Pines Suite 082 Gladysshire, IL 22944-1919

- Phone : +1 (618) 439-8511

- Company : Beahan, Emmerich and Kerluke

- Job : Computer Specialist

- Bio : Quis ea a est. Eaque voluptatem dicta accusantium enim. Vel officia ex vitae consequatur non placeat voluptas.

Socials

tiktok:

- url : https://tiktok.com/@lou_tremblay

- username : lou_tremblay

- bio : Eveniet et ipsa earum. Autem ab minus eum vel voluptate debitis.

- followers : 5192

- following : 299

linkedin:

- url : https://linkedin.com/in/lou.tremblay

- username : lou.tremblay

- bio : Enim aperiam eum ea aliquid dolor.

- followers : 1426

- following : 1400

twitter:

- url : https://twitter.com/tremblay2009

- username : tremblay2009

- bio : Architecto inventore quasi et pariatur. Iusto vero est rerum commodi blanditiis. Cum ab qui ex in aspernatur. Enim est dolorem ut.

- followers : 4809

- following : 820